Welcome. You’ve taken a bold step toward securing your financial future. Every stage of your life matters, and being financially prepared makes all the difference.

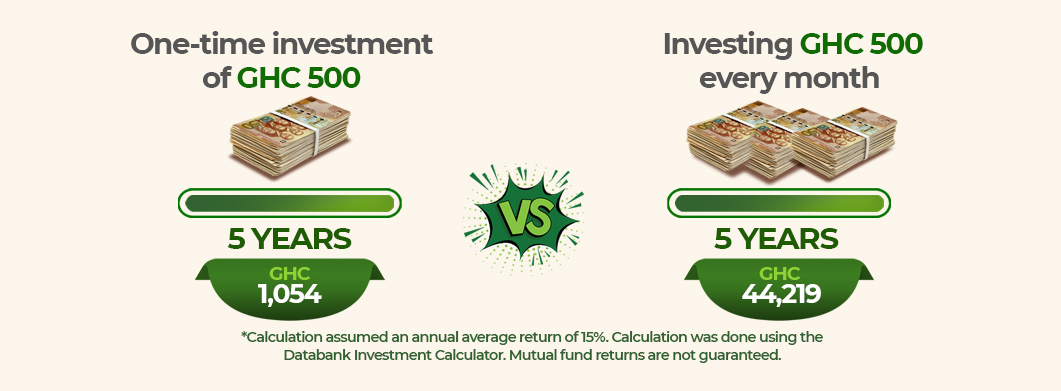

Direct Debit helps you to take advantage of the power of consistency through automated deductions. With every investment, you are getting closer to achieving your goals. It’s a simple yet powerful way to stay on track, build financial discipline, and create lasting growth.

Your future self will thank you for this commitment.